Grow

We're Your Support

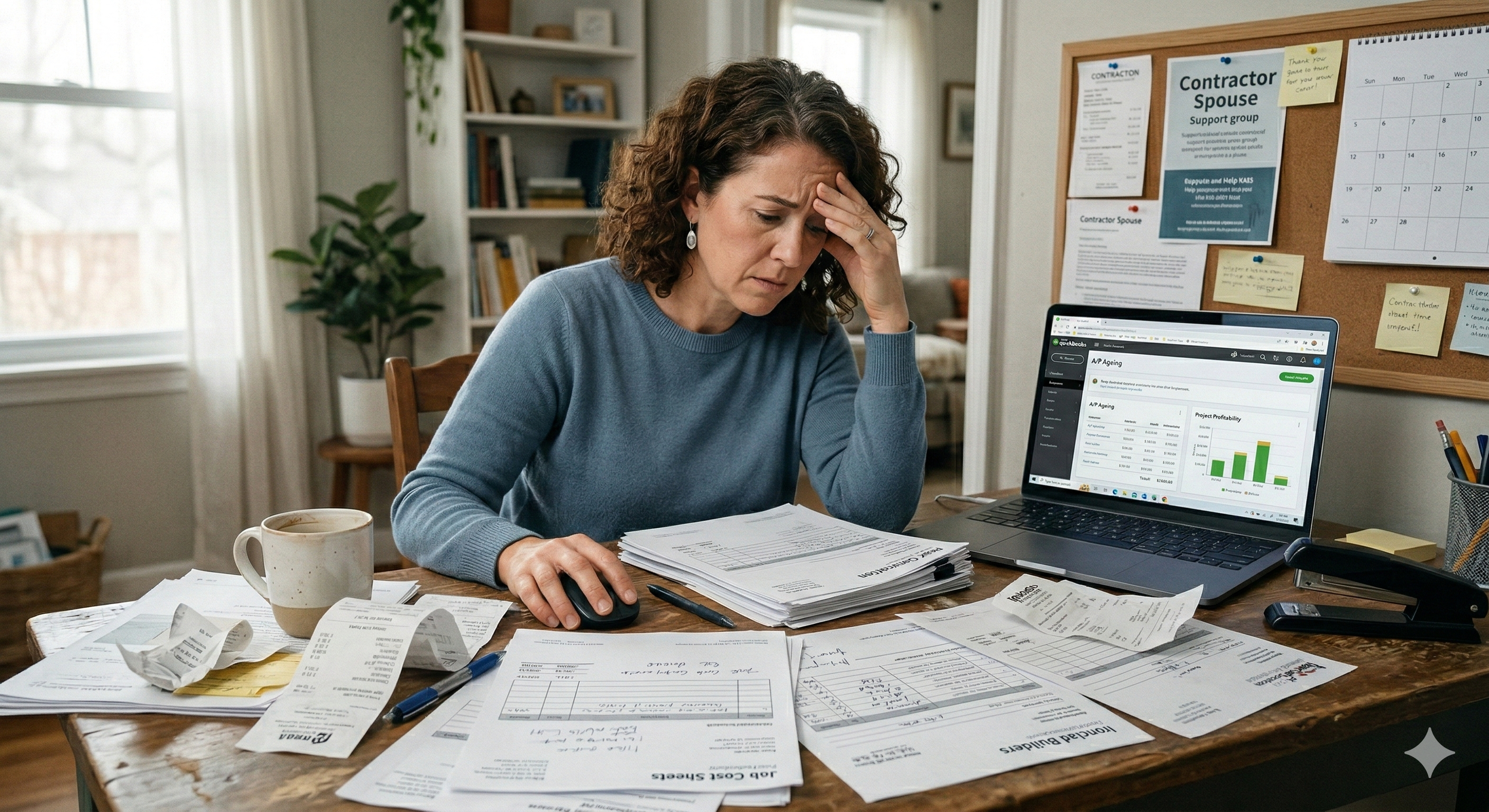

You're in the Hustle Stage. Jobs are getting done, clients are happy, money is coming in — but there's no real system yet. Everything runs through you

Who it's for:

- You have time and want to learn

- You want full control and understanding

- You like being hands-on but want expert oversight

What we do:

- Set up your systems (QuickBooks, job costing, cash flow tracking)

- Train you to run them correctly

- Quarterly review and reconciliation (we check your work and catch anything that's off)

- Quarterly coaching calls to answer questions and build your skills

- Business tax return and personal tax planning

- You're never on your own – we're your backup

Investment:

| $500K - $1.5M | $525/month |

| $1.5M - $3M | $700/month |

| Over $3M | $900/month |